サンライフ社の重病保険サン・ヘルス / Sun Life SunHealth

- ガン・急性心筋梗塞・脳卒中・糖尿病を含む132種類の重病もカバーし、万一の場合に備える外貨保障。

- 65才まで加入が可能で終身の100才まで保障が継続。たとえば加入者55才は保険金額US$20万まで自己申告のみ、健康診断不要でさらに最大1000%のUS$200万まで受け取り可能。

- 疾病保障だけでなく、解約しても貯蓄性があるほか死亡時には遺族へ保険金が相続税ゼロの香港で支給されるので、計画的な資産形成ができる。

- 対象疾患の軽度の病歴があっても加入できるので、まとまった保険金で経済的な負担と将来の経済不安に備える。

サンライフ社が提供しているサンヘルスは、保険の種別として英語でCritical Illness Insurance、単にC.I.言われているもので日本語に直訳すると単に、重病保険となります。

米国では公的医療保険が不十分なので、盲腸の手術に何百万円要すると聞いたことがある人は多いのでないでしょうか。日本では公的医療保険の補完的意味あいのある民間保険会社では、重病に備える保険として入院したら1日何円、悪性腫瘍にはガン保険など指定の病気を患うと何円というように、細かな内容と条件ごとにプランが存在している場合が多くなります。しかし、ここオフショア香港のCI(重病保険)では予め決められた多種多様な病気と診断されるやいなや、一括でまとまった給付金を患者本人やその家族である受取人に、支給されることになります。

超少子高齢化で年金制度とともに公的医療保険制度も崩壊し、前述の貧富の激しい米国のように備えのない人は適切な医療を受けらない時代が来るかもしれません。万一そのようになったとしても、いち早くオフショア香港で当該重病保険に加入していた賢明な方は、重い病いが発生した「その時、その時代」には充分な外貨建ての保障を受け取り、収入面の不安と健康を取り戻すための気力をきっとサポートしてくれることでしょう。

- 1. サンヘルスは132種類にも及ぶ病気をカバー

- 2. オリックス生命の特定疾病保障保険のWithとの比較

- 3. サンヘルスMaxiCare(至尊)で保障額の1000%までカバー

- 4. サンヘルスのプラン詳細 5つのポイント

- 4.1. 10年以内の発病には追加の全面保障あり Tailor-made Enhanced Benefit 10 for you[1]

- 4.2. 初期の段階にも保障が充実 Supporting you with an Early Stage Booster Benefit[2]

- 4.3. 糖尿病にも保障あり Well-protected with the Diabetes Protector Benefit

- 4.4. 癌や心臓病や脳卒中の再発にも保障 Protection where it’s most needed – Recurring Benefit for Cancer, Heart Attack or Stroke

- 4.5. 再発による医療費や無収入による負担を軽減 Ease your concern on huge treatment costs when suffer from cancer or other critical illnesses again

- 5. 保障額の300%~1000%を給付

- 6. 対象疾患一覧表 List of Covered Illnesses

- 7. 給付金請求方法 Critical Illness Benefit Claim Form

- 8. 香港の保障と貯蓄性の高い重病保険の詳細

- 9. 必要書類と身体検査について

- 10. サン・ヘルスのUltra&Maxi Care 全護と至尊

- 11. UltraCare(全護) 保障額の300%までカバー

サンヘルスは132種類にも及ぶ病気をカバー

SunHealthは132種類にも及ぶ病気をカバーしてくれます。

SunHealthは132種類にも及ぶ病気をカバーしてくれます。

132種[4](62種の後期重病 + 61種の初期重病 + 9種の児童疾病)を総合的にカバーする以外に、さらに終身の貯蓄性が備わっているプランです。

公的医療保険や民間保険の保障で、入院費と細かな医療費の一助になるかもしれませんが、重病患者となれば回復経過中には仕事ができず、収入の損失で家族への生活費を捻出するのが、往々にして難しくなります。また、使途は制限されていないので、その保障金は何に使ってもかまわず、先進医療(公的保険適用外など)の高額な支出に備えるために加入する懸命な方も多くいらっしゃいます。

保障は様々の疾患をカバーしてくれるので、病に伏せまさに必要なその時に、まとまった給付金の一時払いを約束してれます。つまり、重病と診断されると保障額の100%[5]の支給や、幸いにも後期重病にまで至らない初期重病や児童疾病と診断された場合にもOriginal Sum Assured(原有保障額)の25%[6]の給付で、収入が途絶える辛い時期のサポートを約束してくれます。

オリックス生命の特定疾病保障保険のWithとの比較

日本で評判のオリックス生命の特定疾病保障保険のWithと、当該プランを比較してみます。三大疾病を同時に網羅しており、掛け捨てでないプランを選択できるので、オリックスのウィズは日本で非常に人気があるようです。

https://www.orixlife.co.jp/products/with/

※GoogleやYahooの検索で「オリックス生命 特定疾病保障保険」と検索すると表示されます。

オリックス生命の上記URLのホームページ上で公開されているパンフレットによると30歳男性が、短期払いの30年間支払い(60才まで支払)を選択し、保障金額1,000万円を目標に定めて見積もりをはじき出します。

オリックス生命の上記URLのホームページ上で公開されているパンフレットによると30歳男性が、短期払いの30年間支払い(60才まで支払)を選択し、保障金額1,000万円を目標に定めて見積もりをはじき出します。

一度も保障を受けなったと仮定した上で解約したとすると、

- 30歳 男性

- 保険期間:終身

- 保険料払込期間:60歳払済

- 低解約払戻期間:60歳

- 保険金額:1,000万円

- 60才時解約金:644.4万円

月払保険料(口座振替扱)24,780円/年払い分297,360円、30年間の払込保険料総額8,920,800円が、60歳時約644.4万円(払戻率72.2%)、80歳時約969.8万円(払戻率108.7%)とオリックスではなってしまうようです。

※所得税や贈与税は考慮していないため、実際さらに利回り/払戻率は低くなります。

一方、オフショア香港のSun Life社の重病保険であると、同じ性別年齢で保障金額10万米ドルと目標に定めます。そうすると、月払保険料262.44米ドル/年払い分2,971米ドルを5年少ない25年間払いこみで済み、払い込み予定総額は74,275米ドル。55才時の払込保険料総額74,275米ドルと総額が8,920,800円と比べて少額で済む(1米ドル1円換算)ほか、60歳時の解約払戻金は104,818米ドル、80歳時の解約払戻金は341,408米ドルとなります。

つまり、80才時に払込保険料総額74,275米ドルに対して、払戻率は459.7%となり、利回りは約4倍お得となるわけです。

以下のとおり比較結果をもういちどテーブルにまとめると

| 香港の重病保険 | 日本の特定疾病保障保険 | |

|---|---|---|

| 月々積み立て金額 | US$262.44を25年のみ | JP¥24,780を30年 |

| 払込保険料総額 | 約US$7.4万 | 約JP¥892万 |

| 対象疾病 | 3大疾病を含む132種 | 3大疾病のみ |

| 保障総額 | US$10万+900% 合計us$100万 | JP¥1,000万のみ |

| 80才時返礼率 | 459.7%(+351%日本比でお得) | 108.7%(-351%香港比で損失) |

保険料支払い分のおよそ、351%分の差額(税抜き)が発生することになります。

サンヘルスMaxiCare(至尊)で保障額の1000%までカバー

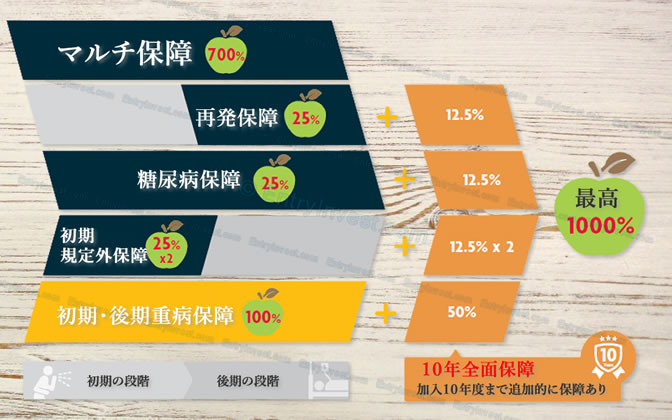

終身900%の保障が確保されているほか、10年以内の発生の場合には追加で100%がプラスされ保障額の10倍である合計1000%[7]まで、保証されることになります。

終身900%の保障が確保されているほか、10年以内の発生の場合には追加で100%がプラスされ保障額の10倍である合計1000%[7]まで、保証されることになります。

つまり、保障額の10倍である最高1000%=900%+100%の給付を受けられるプラン、MaxiCare(至尊)。

MaxiCare(至尊)での具体例

性別と名前: 男性 Mr. A

年齢: 35才

保障額の最高10倍(1000%)を給付されるMaxiCare(至尊)を選択

保障額: 80万香港ドルをOriginal Sum Assured(原有保障額)を希望

保険料払い込み期間: 25年

保険料年間払い込み金額: 27,976香港ドル/年(月々2,471香港ドル)

保険料払い込み予定総額: 25年×27,976香港ドル/年=699,400香港ドル

疾患による給付金額の合計: 63才まで合計2,300,000香港ドルの給付が一括支給済み、当該シュミレーションは以下、年齢や病歴の条件で計算しました。

| 年齢 | 保障回数 | 病状 適応項目(割合%) 保障Group |

保障金額 |

|---|---|---|---|

| 契約5年目の40才 | 初めての保障 | Mr.Aさん体調がすぐれなく医者の診断を経て血管形成手術/Angioplasty | Original(原有)37.5%分のHK$30万 |

| 初期規定外保障(25%)+10年全面保障(12.5%) | |||

| Group3の初期重病が適用 | |||

| 契約17年目の52才 | 2回目の保障 | 体調がすぐれなく病院で大腸ガン/CIS of Colonに患っていると診断 | Original(原有)25%分のHK$20万 |

| 初期規定外保障(25%) | |||

| Group1の初期重病が適用 | |||

| 契約20年目の55才 | 3回目の保障 | 突然倒れて救急治療室に、検査後血管が収縮していたので再度、血管形成手術/Angioplasty | Original(原有)25%分のHK$20万 |

| 初期重病保障(25%) | |||

| Group3の初期重病が適用 | |||

| 契約22年目の57才 | 4回目の保障 | 再び心臓発作/Heart Attackが発生 | Current(現有)100%分のHK$60万 |

| 後期重病保障(100%) | |||

| Group3の後期重病が適用 | |||

| 契約24年目の59才 | 5回目の保障 ※1年の待機期間は要 |

脳卒中/Strokeが発生 | Original(原有)100%分のHK$80万 |

| マルチ保障(100%) | |||

| Group4の後期重病が適用 | |||

| 契約30年目の65才 | 6回目の保障 | 重度の閉塞性睡眠時無呼吸/Severe Obstructive Sleep Apneaと診断 | Original(原有)25%分のHK$20万 |

| マルチ保障(25%) | |||

| Group5の初期重病が適用 | |||

| 65才までの給付金額の合計は、287.5%以上となるHK$230万 |

給付された保障金の総額は230万香港ドル+スペシャルボーナス、つまり、Original Sum Assured(原有保障額)の287.5%%以上の保障が一括支給済み。

サンヘルスのプラン詳細 5つのポイント

1.10年以内の発病には追加する全面保障あり、2.初期の段階にも保障が充実、3.糖尿病にも保障あり、4.癌や心臓病や中風の再発にも保障、5.再発による医療費や無収入による負担を軽減

1.10年以内の発病には追加する全面保障あり、2.初期の段階にも保障が充実、3.糖尿病にも保障あり、4.癌や心臓病や中風の再発にも保障、5.再発による医療費や無収入による負担を軽減

10年以内の発病には追加の全面保障あり Tailor-made Enhanced Benefit 10 for you[1]

保険に加入してすぐにでも保障があればいいものです。そこで、保険加入の年度より10年以内に如何なる対象疾病を患わってしまった場合には、特別に給付金額の50%を追加されるので、保障額の1.5倍が支給されることになります。このEnhanced(強化された)カバレッジは、家庭の支出負担を減らすのに役立つほか、公的医療保険の対象外の先進医療にかかる費用の捻出も現実的に可能となるでしょう。

- 初期規定外保障/Early Stage Booster Benefit[2]

- 糖尿病保障/Diabetes Protector Benefit[3]

- 後期重病保障/Major Stage Critical Illness Benefit[5]

- 初期重病保障/Early Stage Critical Illness Benefit[6]

- 再発保障/Recurring Benefit[7]

- 死亡保障/Death Benefit[8]

保険加入後の10年以内であれば、以上の給付申請には追加で50%の追加的な保障を提供するほか、さらにCurrent Sum Assured(現有保障額)は10年全面保障の支給後にも減少しません。

初期の段階にも保障が充実 Supporting you with an Early Stage Booster Benefit[2]

病気から回復したいなら、とにかく一刻も早く治療を受けることが肝心です。また、医療技術の日進月歩により、重病でさえも回復の機会が大幅に増加しています。

そこで、当該プランのサンヘルスでは、特に4種のよく見られる初期重病を規定外として定め、ブースター的な保障が付加されます。具体的にいうと、初期重病ごとの請求は1度に限定されますが、以下の4つの初期重病者に限っては、2度の給付(*毎回の給付額はOriginal Sum Assured/原有保障額の25%を限度とする)請求が可能となり優遇されます。

- 前癌病変または初期悪性腫瘍/Carcinoma-in-situ (“CIS”) or Early Malignancy[9]

- 血管形成術とその他冠状動脈の創傷性治療法/Angioplasty and Other Invasive Treatments for Coronary Artery Disease (“Angioplasty”)

- ペースメーカまたは除細動器の挿入/Insertion of Pacemaker or Defibrillator

- 頸動脈形成術及びその他頸動脈手術/Angioplasty and Other Surgeries for Carotid Arteries

* 被保険者一人ごとの保障給付の上限額は37,500米ドル/ 30万香港ドル。

さらに、普通の初期保障給付と異なり、初期規定外保障の支給後においては、当該基本プランのCurrent Sum Assured(現有保障額)は減少しないことになり、仮に後期重病となれば結果、Original Sum Assured(原有保障額)の100%が給付されることになります。

糖尿病にも保障あり Well-protected with the Diabetes Protector Benefit

糖尿病はアジアでも急速に増加している疾患の一つであり、その傾向は社会のあらゆる層や世代にわたってきています。

日本でも予備群を合わえると2,000万人がが糖尿病に苦しんでいますが、まだまだ危機感は低いようです。糖尿病は多くの重大な病気に招来してしまう要因でもあり、その潜在的なリスクは深刻で、いま糖尿病に患っていなくても、いかなる年齢でも2型糖尿病が発症する可能性があります。

そこで、当該プランのサンヘルスは糖尿病のリスクに対応し、適切な保護を提供するために以下の糖尿病関連疾患と診断された時に追加の保障を提供します。

| 保証対象疾患 | 疾患種類 | 保障金額[3] |

|---|---|---|

| 糖尿病合併症/Diabetic Complications | 後期重病の症状 | Original Sum Assured(原有保障金)の25%の追加保障 + 後期重病保障内の給付金 |

| 糖尿病性腎症/Diabetic Nephropathy | 初期重病の症状 | Original Sum Assured(原有保障金)の25%の追加保障 |

| 糖尿病性網膜症/Diabetic Retinopathy | 後期重病の症状 | |

| インスリン依存型糖尿病/Insulin Dependent Diabetes Mellitus*(IDDM) | 児童疾病の症状 |

* 18才までの保障有効期間

癌や心臓病や脳卒中の再発にも保障 Protection where it’s most needed – Recurring Benefit for Cancer, Heart Attack or Stroke

ガンや心臓発作や脳卒中は非常に再発することが多く、結果治療費は高額になりがちです。さらに、保険の中には最初に患ったときの診断給付金が一度しか出ないタイプで、一度受け取ってしまうと保険の適用は終了してしまうものが多いので、注意が必要です。

当該プランのサンヘルスでは、仮にガンや心臓発作や脳卒中による重病保障を受け取り済みで、その初回の診断給付金が支払われることとなった診断確定日から起算して4年から6年目以降に再診を受けて同様の重病と診断確定されると、Recurring Benefit(再発保障)を根拠に原有保障額の25%の追加給付が再び支給されるメリットがあります。

再発による医療費や無収入による負担を軽減 Ease your concern on huge treatment costs when suffer from cancer or other critical illnesses again

香港も日本やその他各国と同じく、死亡原因の1位は男女ともガンです。新しい技術や治療法が発見されるにつれて、治療費は増加の一途をたどってきています。当該プランのサンヘルスは、不幸にも保険対象のガンと診断された場合には、患者本人および患者の家族にかかる治療費の負担を軽減し、治療に専念できるようサポートする医療保険となっています。

MaxiCareはガンGroupの中で保障金額の最大400%をガン給付。保障金額の4倍にも達するMulti-Protection Benefit(マルチ保障)[10],[11]は、家族の財政負担を軽減し、治療に集中できるようにしてくれるでしょう。

ガンは一度治ったと思っても「再発」で再度治療しなければならなくなってしまう可能性のある病気です。

したがって、Cancer-free waiting period(ガンの無い待機期間)を僅か4年[12]と定め、再発の保障再請求が可能になり、より強力な保障を提供します。

ガンや他の重病を除いた当該マルチ保障のメリットとしては、初期重病には待機期限を設けていません。つまり、後期重病保障及び╱或いは初期重病保障の給付金合計額がOriginal Sum Assured(原有保障額)の100%に達した場合、事後の保険料はすべて免除されます。

その他の利点

| 病気のGroup | 最大請求総額/Maximum Total Claims Limit* (% of Original Sum Assured) |

|---|---|

| Group 1: ガン/Cancer | 400% |

| Group 2: 臓器不全と関連する疾患/Illnesses related to Major Organs & Function | 100% |

| Group 3: 臓器不全と関連する疾患/Illnesses related to the Heart | 100% |

| Group 4: 神経系と関連する疾患/Illnesses related to the Nervous System | 100% |

| Group 5: その他疾患/Other Major Illnesses | 100% |

| TOTAL | 800% |

* The maximum total claim limit includes the respective claim limit of Major Stage Critical Illness Benefit, Early Stage Critical Illness Benefit and Multi-Protection Benefit of the Basic Plan.

| 前の後期重病給付請求/Previous Major Stage Critical Illness Claim | 事後の給付請求/Subsequent Claim | 期間条件/Waiting Period |

|---|---|---|

| Group 1 | Group 1の後期重病 | ガンの無い待機期間4年[12] |

| Group 1 | Group 2/3/4/5の後期重病 | 1年の待機期間 |

| Group 2/3/4/5 | Group 1/2/3/4/5の後期重病 | |

| 末期症状/Terminal Illness | Group 1/2/3/4の後期や初期重病もしくは児童疾病 | 5年の待機期間 |

保障額の300%~1000%を給付

100%もしくは25%の保障を実現、さらに最高10倍の1000%まで保障

潜在する各種重病に対して手厚い保障を実現。

- 後期重病には保障額の100%

- 初期重病や児童疾病には保障額の25%

- 再発やその他の疾患が同時発病300%~1000%

たとえば、後期重病と診断されると直ちに保障額の100%を受け取れるほか、幸運にも後期重病に至らない「初期」性の重病や「児童」の疾病と診断されると保障額の25%が予め給付されます。

さらに、万が一、現実に後期重病の複数が立て続けに診断されたときや再発してしまった、その時「当該保障額で本当に十分なのか?」といった不安感をなくすために、UltraCare(全護)はOriginal Sum Assured(原有の保障額)の300%(3倍)、MaxiCare(至尊)は1000%(10倍)まで保障を提供してくれます。

- UltraCare(全護)

保障額の最高3倍(300%)を給付 - MaxiCare(至尊)

保障額の最高10倍(1000%)を給付

保障期間は終身の100才、保険料免除も

それだけでなく終身の100才まで保障してくれます。

保険期間は100才までとなるので、重病を患いやすい後半のライフステージにおいて十分な保障を確約してくれます。これにより、退職後の金銭的に余裕がないその時に不幸にも重病を患ってしまった場合の「収入や年金がないので高度な医療費用を払えない!」そんな悩みは当該保険が解消してくれます。

初期重病及び╱或は後期重病保障請求がOriginal Sum Assured(原有の保障額)の100%に達していると、それ以降の保険料が免除されるので如何なる追加の費用なしで残された保障を享受することができます。

対象疾患一覧表 List of Covered Illnesses

The English disease name governs./病名は、英語を正文とします。

* 毎回の最高請求額は37,500米ドル/300,000香港ドル以下。

# 保障年齢期限は65~85才のみ。

^ 保障年齢は70歲以下、保障金額は15,000米ドル/120,000香港ドルを上限とする。

** 末期の病気はマルチ保障((MaxiCare(至尊))のみ申請可能)の対象となりません。

給付金請求方法 Critical Illness Benefit Claim Form

Sunlife社も連絡がない限り被保険者が重病を患った事実を把握できません。このため、弊社のカスタマーサポートに日本語でできるだけ早く連絡することが必要で、英文の医師の診断書を含む申請手続きのサポートを日本語で行います。

Attending Physician’s Statement(主治医の診断書)に関して、日本の医師も非常に高学歴で、英文での作成は大丈夫なようです。また、医師にとっては、保険給付金のための診断書の作成は医師の義務となり、自費扱いとなり自由な価格設定で無料~10,000円ほどのようです。その書式はSunlife社のものを利用し英語ですが、いたって簡単でたとえば癌の場合であると2ページに記載し、医師の印鑑と署名をもらうことになります。

香港の保障と貯蓄性の高い重病保険の詳細

当該商品、サンライフ社の学資保険サン・ヘルスをテーブルで以下のようにまとめます。

| 準拠法/契約地 | 香港 |

|---|---|

| 契約通貨 | 米ドル or 香港ドル |

| 払い込み期間 | 5,10,15,20,25年から選択 |

| 最低保険金額 | 20,000米ドル or 160,000香港ドル |

| 最低月々保険料 | 例えば、 40才女性で15年払いの場合、月々約100米ドル 50才男性で5年払いの場合、月々約400米ドル |

| 支払い方法 | 以下のいずれか 月々/半年/1年ごとに香港の銀行から引き落とし or 日本の銀行からの送金 or VISA/Masterカードで引き落とし |

| 保険契約期間 | 100才満期の終身 |

必要書類と身体検査について

受益者兼被保険者である子供は香港に渡航する必要がありません。契約者である親や祖父母のみ香港の法律に準拠して契約するため、必ず渡航する必要があります。

お申し込み時に必要となる証明書類

| 契約者 | |

|---|---|

| ID | パスポート ※香港入国時のミニスリップも必要、入国スタンプの代わりに貰う用紙です。 |

| 住所証明書 | 運転免許証 or 住民票 ※国際免許証である必要なし |

| 健康状態の告知書 | 日本語で記載していただき署名が必要。後に弊社で翻訳します。 |

健康診断/身体検査が必要となるボーダライン

| 年齢(才) | 保障限度額(US$) | 1000%保障(US$) |

|---|---|---|

| ~65 | ~35,000 | ~350,000 |

| ~60 | ~70,000 | ~700,000 |

| ~55 | ~200,000 | ~2,000,000 |

| ~50 | ~400,000 | ~4,000,000 |

| ~45 | ~600,000 | ~6,000,000 |

例えば、45才の男性であると最大60万米ドルの保障金額を目標に設定して、香港で健康診断を受けることなく健康状態の告知書を作成することにより、加入することができます。ちなみに、その場合の保険料に関して、例えば45才男性非喫煙者と仮定するし年払いは59,052米ドル/年を10年払いを選択すると、香港にて健康診断不用で且つ60万米ドルを最大保障金額として、契約可能となります。

Remarks:

1 Enhanced Benefit 10 is equal to 50% of the (i) Current Sum Assured payable under Major Stage Critical Illness Benefit, Early Stage Critical Illness Benefit or Death Benefit; or (ii) Original Sum Assured payable under Early Stage Booster Benefit, Diabetes Protector Benefit or Recurring Benefit. Enhanced Benefit 10 will not be eligible for Guaranteed Cash Value and Special Bonus, if any, and will be automatically terminated (i) once Death Benefit becomes payable; (ii) on the 10th policy anniversary; and (iii) upon termination of this Basic Plan, whichever is earliest. Current Sum Assured will remain the same upon payment of Enhanced Benefit 10.

2 Current Sum Assured of this Basic Plan will remain the same after Early Stage Booster Benefit is paid. Unless otherwise specified, if a claim for an Early Stage Critical Illness Condition is made under Early Stage Booster Benefit, no claim will be payable under Early Stage Critical Illness Benefit for the ame Early Stage Critical Illness Condition at the same time, and any subsequent claim of such Early Stage Critical Illness Condition will not be payable under Early Stage Critical Illness Benefit (except for Angioplasty and Other Invasive Treatments for Coronary Artery Disease, Carcinoma-in-situ and Early Malignancy9). Early Stage Booster Benefit will be terminated automatically (whether claimed or not) when Current Sum Assured is reduced to 0.

The claims(s) made under Early Stage Booster Benefit will not be counted towards the limit for Multi-Protection Benefit.

3 Diabetes Protector Benefit can be claimed once only and will be terminated afterwards. Unless otherwise specified, if a claim for an Early Stage Critical Illness Condition or a Juvenile Illness Condition is made under Diabetes Protector Benefit, no claim will be payable under Early Stage Critical Illness Benefit for the same Early Stage Critical Illness Condition or Juvenile Illness Condition at the same time. If a claim for a Major Stage Critical Illness Condition, an Early Stage Critical Illness Condition or a Juvenile Illness Condition is made under Diabetes Protector Benefit, any subsequent claim of such Major Stage Critical Illness Condition, Early Stage Critical Illness Condition and Juvenile Illness Condition will not be payable under the respective Major Stage Critical Illness Benefit or Early Stage Critical Illness Benefit. For Early Stage Critical Illness Condition, and Juvenile Illness Condition, the maximum per life limit of each claim: US$37,500 or HK$300,000. If the Diabetes Protector Benefit is payable due to Diabetic Complications, the Major Stage Critical Illness Benefit will also be payable at the same time (The Major Stage Critical Illness Benefit payable is subject to the terms and conditions

as specified in Major Stage Critical Illness Benefit under the Basic Benefit provisions). Current Sum Assured of this Basic Plan will remain the same if the claim is Early Stage Critical Illness Condition or Juvenile Illness Condition, while the Current Sum Assured of this Basic Plan will be reduced to 0 after this benefit is paid for a Major Stage Critical Illness Condition. Diabetes Protector Benefit will be terminated automatically (whether claimed or not) when Current Sum Assured is reduced to 0. The claim(s) made under Diabetes Protector Benefit will not be counted towards the limit for Multi-Protection Benefit.

4 Unless stated otherwise, each Juvenile Illness Condition, Early Stage Critical Illness Condition and Major Stage Critical Illness Condition can be claimed once only. All benefit payouts will be reduced by any outstanding loans with interest.

5 Major Stage Critical Illness Benefit will only be paid once. Once the Major Stage Critical Illness Benefit becomes payable, coverage for Major Stage ritical Illness Benefit, Death Benefit, Early Stage Critical Illness Benefit, Early Stage Booster Benefit, Diabetes Protector Benefit, Maturity Benefit and any Rider Benefit(s) attached to this Basic Plan will terminate automatically.

Major Stage Critical Illness Benefit is equal to the higher of:

(i) sum of 100% of the Current Sum Assured, plus Enhanced Benefit 10, if applicable, plus face value of Special Bonus, if any; and

(ii) total Premiums due and paid for this Basic Plan excluding any extra premiums and any Rider Benefit premiums, less the amount of any benefit paid;

Plus any other amounts left with us, less the amount of any loans with interest.

Major Stage Critical Illness Benefit will be terminated automatically when the Current Sum Assured is reduced to 0.

6 In the case of the payment of Early Stage Critical Illness Benefit when the Current Sum Assured is less than 25% of the Original Sum Assured, only the Current Sum Assured is payable under Early Stage Critical Illness Benefit, subject to maximum per life limit of the relevant illness condition(s).

After the payment of each Early Stage Critical Illness Benefit, Current Sum Assured17, Guaranteed Cash Value, Special Bonus (if any) and Premium will be reduced on a pro rata basis accordingly.

7 Terms and conditions of benefits and exclusions apply. Please refer to the Policy Documents for details.

8 Death Benefit is equal to the higher of:

(i) sum of 100% of the Current Sum Assured, plus Enhanced Benefit 10, if applicable, plus face value of Special Bonus, if any; and

(ii) total Premiums due and paid for this Basic Plan excluding any extra premiums and any Rider Benefit premiums, less the amount of any benefit paid; plus any other amounts left with us, less the amount of any loans with interest. Death Benefit will be terminated automatically when Current Sum Assured is reduced to 0.

9 Only specific organs and stages of Carcinoma-in-situ or Early Malignancy are covered. Carcinoma-in-situ means Carcinoma-in-situ of Colon or Rectum, Liver, Lung, Nasopharynx, Stomach or Oeshophagus, Urinary Tract, Breast, Cervix, Uterus, Ovary, Fallopian Tube, Vagina, Testicle or Penis; Early Malignancy means Early Stage Cancer of the Prostate, Early Stage Papillary Carcinoma of Thyroid and Non-melanoma Skin Cancer of AJCC Stage II or above. Please

refer to the Policy Document for the details of definition.

10 Following the total payment of 100% Original Sum Assured under Major Stage Critical Illness Benefit and/or Early Stage Critical Illness Benefit, the eligible claims of Major Stage Critical Illness Condition, Early Stage Critical Illness Condition and Juvenile Illness Condition up to a maximum of 700% of Original Sum Assured will continue to be payable under Multi-Protection Benefit, subject to the following conditions:

(1) Major Stage Critical Illness Condition under Major Stage Critical Illness Benefit paid and Major Stage Critical Illness Condition of each claim under Multi-Protection Benefit shall fall within different groups* of the Major Stage Critical Illness Conditions (except for Multiple Claims for Major Stage Critical Illness Condition of Group 1 as specified in (3) and (4) below);

(2) the date of Diagnosis or Surgery Date of the Major Stage Critical Illness Condition of a Multiple Claim shall be at least 1 year from the date of Diagnosis or Surgery Date of the Major Stage Critical Illness Condition of the immediately preceding approved claim for Major Stage Critical Illness Benefit or Multi-Protection Benefit (for the avoidance of doubt, no such period is required for (a) an Early Stage Critical Illness Condition where the immediately preceding approved claim is a Major Stage Critical Illness Condition (except for Terminal Illness as specified in (6) below) or an Early Stage Critical Illness Condition; or (b) a Major Stage Critical Illness Condition where the immediately preceding approved claim is an Early Stage Critical Illness Condition);

(3) Major Stage Critical Illness Benefit, Early Stage Critical Illness Benefit and Multi-Protection Benefit allow approved claims up to a maximum of 400% of Original Sum Assured for illness conditions under Group 1 and a maximum total of 100% of Original Sum Assured for illness conditions under Group 2, 3, 4 or 5 respectively (excluding Early Stage Booster Benefit, Enhanced Benefit 10, Diabetes Protector Benefit and Recurring Benefit, if applicable);

(4) in the case of a claim for a Major Stage Critical Illness Condition of Group 1 under this Multi-Protection Benefit, if this Major Stage Critical Illness Condition occurs after an approved claim for a Major Stage Critical Illness Condition of Group 1, in addition to the condition (2) above, the date of Diagnosis or Surgery Date of this Major Stage Critical Illness Condition shall be after the expiry of a 4-year Cancer-Free Waiting Period12 in relation to the immediately preceding approved Group 1 claim on Major Stage Critical Illness Condition;

(5) even if there is/are claim(s) for Early Stage Critical Illness Condition(s) in between two Major Stage Critical Illness Conditions, the conditions as specified in (1), (2), (3) and (4) are applicable to these two Major Stage Critical Illness Conditions;

(6) if the Major Stage Critical Illness Condition paid under the Major Stage Critical Illness Benefit was Terminal Illness, the first claim under this Multi-Protection Benefit can be made from Group 1, 2, 3 or 4 of Major Stage Critical Illness Conditions, Early Stage Critical Illness Conditions or Juvenile Illness Conditions, provided that the date of Diagnosis or Surgery Date of the condition of such claim shall be at least 5 years from the date of

Diagnosis of such Terminal Illness;

(7) the Insured shall have survived for a period of at least 14 days from the date of Diagnosis or Surgery Date of the Major Stage Critical Illness Condition, Early Stage Critical Illness Condition or Juvenile Illness Condition (where applicable); and

(8) In the case of the payment of Early Stage Critical Illness Benefit when the Current Sum Assured is less than 25% of the Original Sum Assured, the Shortfall in Sum Assured in respect of the same Early Stage Critical Illness Condition or Juvenile Illness Condition (where applicable) will be payable under Multi-Protection Benefit at the same time, subject to the respective maximum per life limit of relevant illness condition and maximum total

claims limit of the relevant group.

* Except that when payment of Major Stage Critical Illness Benefit is made at the time the Current Sum Assured is less than 100% of the Original Sum Assured, the Shortfall in Sum Assured in respect of the same Major Stage Critical Illness Condition will be payable under Multi-Protection Benefit at the same time, subject to the respective maximum total claims limit of the relevant group.

11 Multi-Protection Benefit will not be eligible for Guaranteed Cash Value and Special Bonus, if any. Additional 25% of the Original Sum Assured under Diabetes Protector Benefit, and any claims paid under Early Stage Booster Benefit, Enhanced Benefit 10 and Recurring Benefit will not be counted towards the total claims limit under Multi-Protection Benefit.

12 The “4-year Cancer-Free Waiting Period” means that the period elapsed is at least 4 years from the date of first diagnosis with respect to the latest admitted Cancer claim under Major Stage Critical Illness Condition to:

(i) the date of first diagnosis with respect to the subsequent Cancer claim under Major Stage Critical Illness Condition which is of a different pathological and histological type (whether it occurs in the same or a different organ); or

(ii) the date of first diagnosis of the recurrence or metastasis of the Cancer of the latest admitted Cancer claim under Major Stage Critical Illness Condition, provided that such Cancer has been once in complete remission (such state is verified by a Registered Specialist and supported by clinical, imaging or other laboratory investigation evidence).

13 The face value of any Special Bonus (if any) will be paid when the Company is paying the (1) Major Stage Critical Illness Benefit, (2) Early Stage Critical Illness Benefit, or (3) Death Benefit. The cash value of Special Bonus will be paid upon the payment of Maturity Benefit or when the policy is surrendered in whole or in part. The cash value of Special Bonus may not be equal to the face value of Special Bonus. A face value of pro rata portion of Special Bonus (if any) will also be paid upon payment of the Early Stage Critical Illness Benefit, followed by Current Sum Assured, Guaranteed Cash Value and Special Bonus (if any) and premiums shall then be reduced on a pro rata basis accordingly. Special Bonus will not be paid after the Current Sum Assured reaches 0. Special Bonus is calculated based on the Company’s current Special Bonus scales which are not guaranteed and will be subject to

change at the Company’s sole discretion from time to time. The Special Bonus may be different at each subsequent declaration and the actual values paid may change with the values. The Company’s Special Bonus will typically vary based on the performance of a number of experience factors, with the investment return, including the impact of asset defaults and investment expenses, normally being the main determinant of the Special Bonus performance. Other factors include, but are not limited to, claim experience, policy expenses, taxes, and policyholder termination experience.

14 The third claim for Angioplasty and Other Invasive Treatments for Coronary Artery Disease under Early Stage Critical Illness Condition will be eligible only if the first 2 claims of Angioplasty and Other Invasive Treatments for Coronary Artery Disease have been paid under Early Stage Booster Benefit.

15 Second Medical Opinion Service and Family Care Benefit Plus are provided by a third party service provider which is not guaranteed renewable.

16 Included Enhanced Benefit 10.

17 Current Sum Assured means the Original Sum Assured, less total amount of Sum Assured paid under Early Stage Critical Illness Benefit. Current Sum Assured will be reduced to zero after the date we approved Death Benefit or Major Stage Critical Illness Benefit claim. Guaranteed Cash Value and Special Bonus will be reduced to zero at the same time when Current Sum Assured is reduced to zero under any circumstances.

18 Where 25% of Original Sum Assured is payable under Early Stage Critical Illness Benefit and 12.5% of Original Sum Assured (additional) is payable under Enhanced Benefit 10. The Current Sum Assured, Guaranteed Cash Value, Special Bonus (if any) and premiums shall then be reduced on a pro rata basis after the date we approved Early Stage Critical Illness Benefit claim.

オフショア香港のSunlife社の商品のお申込みついて

SunLife/永明金融の創業は実に1865年にさかのぼり、個人や企業への保険商品をご提供してきた北米でも最も古い金融機関の一つです。現在ではカナダのトロントに本社をかまえ日本を除く世界23カ国にオフィスを設けるグローバル企業として成長し続けています。

SunLifeの商品につき取り扱い商品

弊社取り扱いお勧め商品としては- 積み立て投信保険のSunAchiever

- 固定配当付き養老保険のSunPromise

- 貯蓄性の高い学資保険のSunEducator

- 貯蓄と保障性を備えた重病保険のSunHealth

- ユニバーサルライフのBRIGHT UL Wealth-Builder

- 保障性の高い学資保険のHopeEducator

- ユニバーサルライフのBRIGHT UL Wealth-Builder

- 保障の高い生命保険であるLifeBrilliance

海外投資家を始めようとする新規顧客や既存顧客を問わず、アフターサポートを提供しております。

| サポート内容抜粋 | 料金(HK$) |

|---|---|

| 商品のご案内 | 無料 |

| 住所や電話番号など各種変更手続き | 1,000/回 ※弊社の顧客は無料 |

| その他、各種手続きやトラブル解決や通訳 | お問合せください |

SunLife香港の基本情報 Fundamental information of SunLife Hong Kong

フォーチュン500やフォーブスグローバル2000において236位(三菱UFJフィナンシャルは369位)にランクインしているほか、グループ全体の総資産額は3469億カナダドルとなり、トロント(TSX)やニューヨーク(NYSE)、フィリピン(PSE)の世界3カ国の証券取引所で上場もしています。

格付けも高くS&PでAA-、ムーディーズでAa3を獲得しており信用度が非常に高いといえるでしょう。

| 名称 | Sun Life Financial (Hong Kong) Limited / 香港永明金融有限公司 又は単に Sun Life Hong Kong |

|---|---|

| 香港所在地 | 8/F, Sun Life Tower,The Gateway, 15 Canton Road,Kowloon, Hong Kong SAR |

| 営業時間 ※香港時間 | 月~金曜日: 9:00~16:30 土曜日: 9:00~13:00 |

| カスタマーホットライン/電話番号 | +852 2103 8928 |

| ホームページURL | https://www.sunlife.com.hk |

| 申請書等の送付先 | 8/F, Sun Life Tower,The Gateway, 15 Canton Road,Kowloon, Hong Kong SAR |